Small high-street businesses in the UK have had a turbulent time over the last few years, with the rise of online shopping and high cost of rent contributing to difficult trading conditions.

That’s one of the reasons we went out and surveyed small businesses on the high street: to find out the opportunities and challenges that come with running a small retail business. We surveyed independent shop owners, café, restaurant and pub owners as well as other retail businesses with between 1 – 25 employees.

As you can see below, the report revealed some interesting findings on the UK retail business sector.

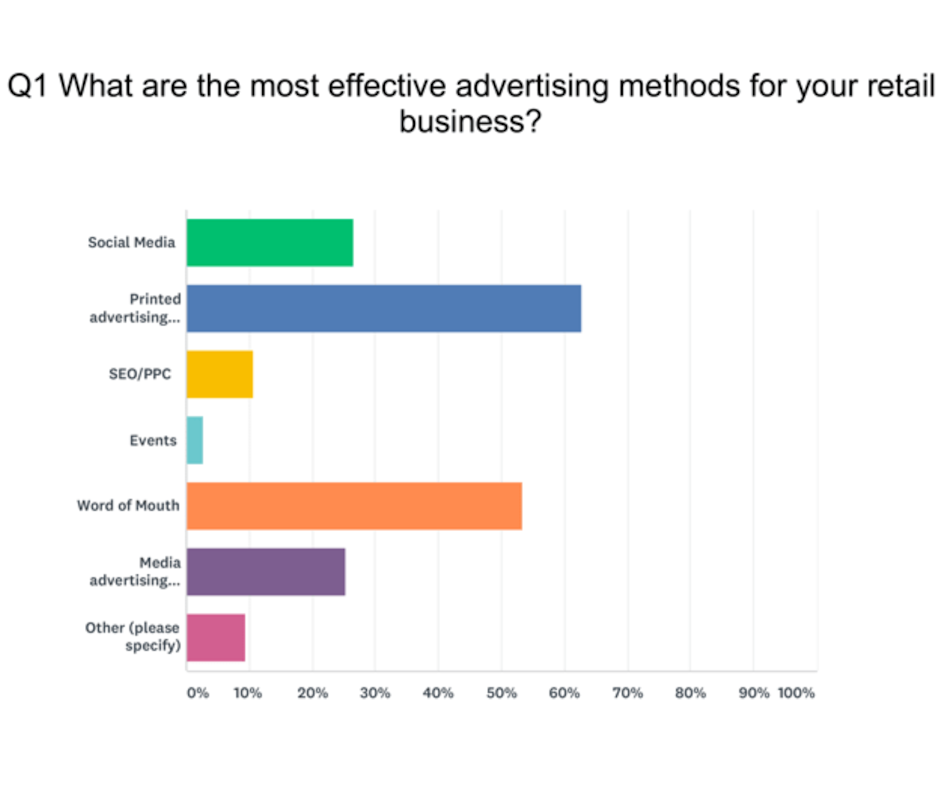

Print Beats Digital for Small Businesses

Advertising methods are constantly changing, which is why we asked this question about the most the best ways to promote a small retail business.

Interestingly in the age of online marketing, printed advertising such as signs and banners was seen as the most effective advertising method for retail businesses on the high street, with 62% of participants selecting this as the most profitable means of advertising.

Word-of-mouth came in as the second most popular method at 53% with social media (26%) and media advertising such as TV, radio and print (25%) following. SEO/PPC (10%) and events (2%) were less popular, with 9% of respondents choosing ‘other’ as a method, with most respondents mentioning their location on the high street as being highly effective.

To summarise, this was a surprising result as it seems that small businesses on the high street predominately rely on traditional advertising such a printed advertising and word of mouth rather than more modern forms of online marketing to attract new business.

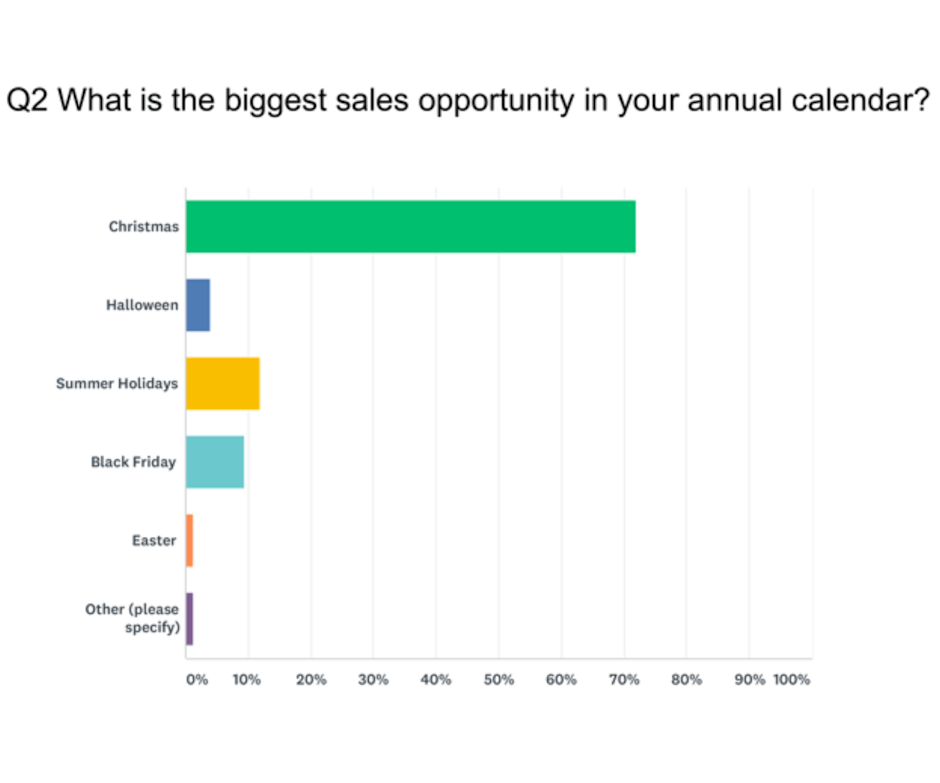

Jingle All The Way

Most retail businesses have seasonal fluctuations in sales, which is why we wanted to know what the biggest sales opportunity in their retail calendar was.

Christmas is by far the biggest event in the retail calendar for small businesses, with 72% of respondents declaring it as the biggest sales opportunity in their annual calendar.

The second most popular opportunity were the summer holidays (12%), followed by Black Friday (9%), Halloween (4%) and Easter (1%).

Christmas is still clearly the key sales period for small businesses, with many business owners calling it their ‘make or break’ period. It is therefore extremely important small retail businesses think carefully about how to promote their business and maximise sales in this period.

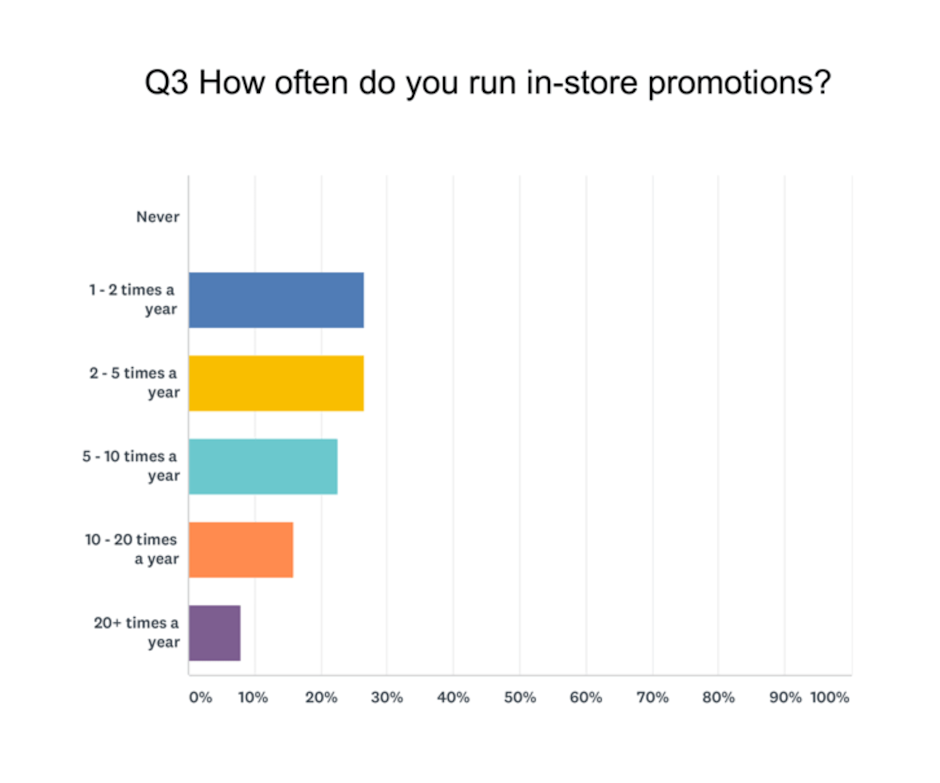

The Never-Ending Sale

In-store promotions such as discounts on product/s or service/s are very popular on the high street, judging from the various sale signs in windows: this question looked to get to the bottom of the regularity that store owners run in-store promotions.

Following on from Question 2 about seasonal sales opportunities, It’s clear that running in-store promotions is crucial for small businesses, which was reflected in the fact that 0 respondents said they never run in-store promotions.

26% of respondents said they run in-store promotions 1-2 times a year with the same amount declaring they run in-store promotions 2-5 times a year, covering the key promotional events at the very least.

Several businesses declared that in-store promotions have to be running almost constantly throughout the year. This is reflected in the number of respondents who selected 5-10 times a year (22%); 10-20 times a year (16%) and 20+ times a year (8%).

To summarise, in-store promotions are extremely important for SMEs on the high street, with many retail business owners running discounts and specific offers to compete with the pricing from online retailers.

(High!) High Street Rents

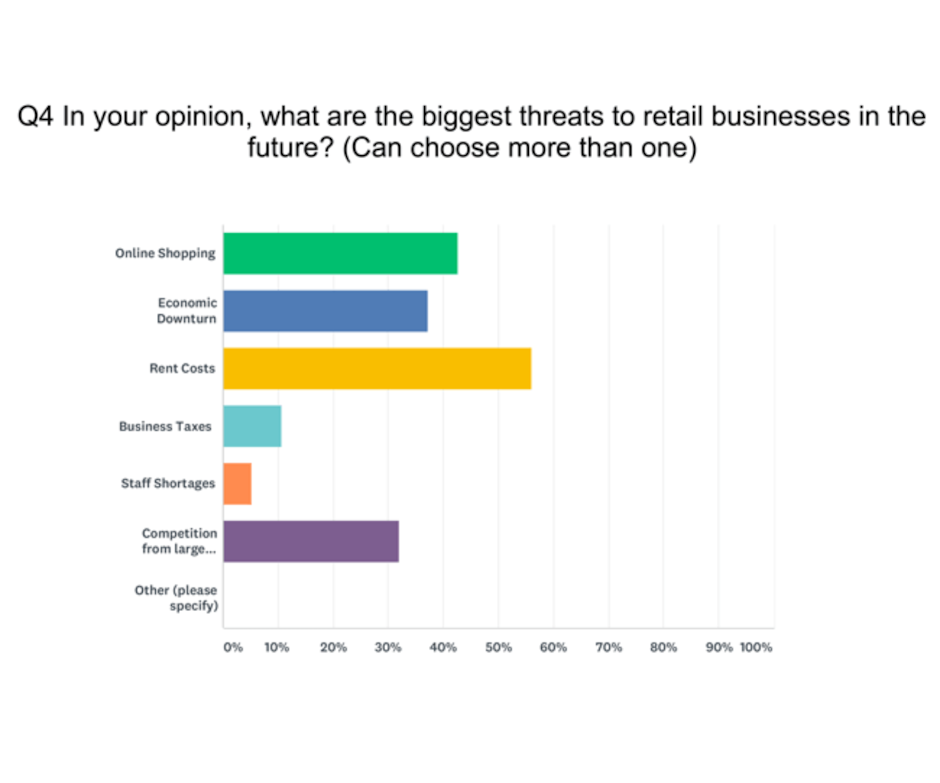

This question asked for the biggest specific threat to the respondents’ retail businesses in the future and, as you can imagine, had a number of passionate responses.

Top of the list of threats was rent costs with 56% of small business owners complaining that high-street rents were a cause for concern in the future.

This was closely followed by external factors such as online shopping (42%); the prospect of an economic downturn (37%); and competition from large retailers (32%).

Business taxes (10%) and staff shortages (5%) were also mentioned as a threat to retail businesses in the future.

To summarise, the dual threat of high rents along with online retailers (who in many cases don’t have to pay for high street premises), posed the most serious threat to retail businesses in the UK.

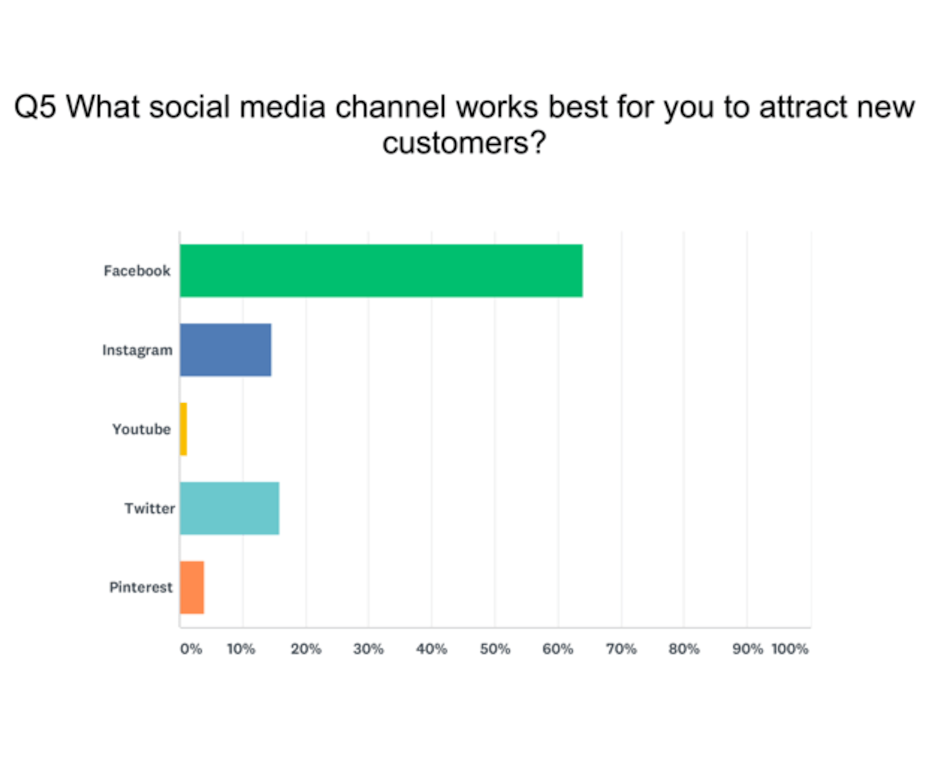

Insta-What? Facebook Reign Supreme

There are so many social media channels out there that it’s difficult to know which is best for small retail businesses in the UK. That’s why we asked the question about which social media channel generated the most sales and brand exposure for small businesses.

The results showed that Facebook was the overwhelming most popular choice with 64% of respondents choosing this option as the best fit for their small business.

The next two most popular channels were Twitter (16%) and Instagram (14%), with Pinterest (4%) and Youtube (1%) making up the numbers.

Overall, it’s clear that Facebook is the best choice for small retail businesses looking to attract new business, this could be because of the channel’s wider user base and demographic as well as it’s targeted advertising opportunities.

Every Cloud Has a Silver Lining

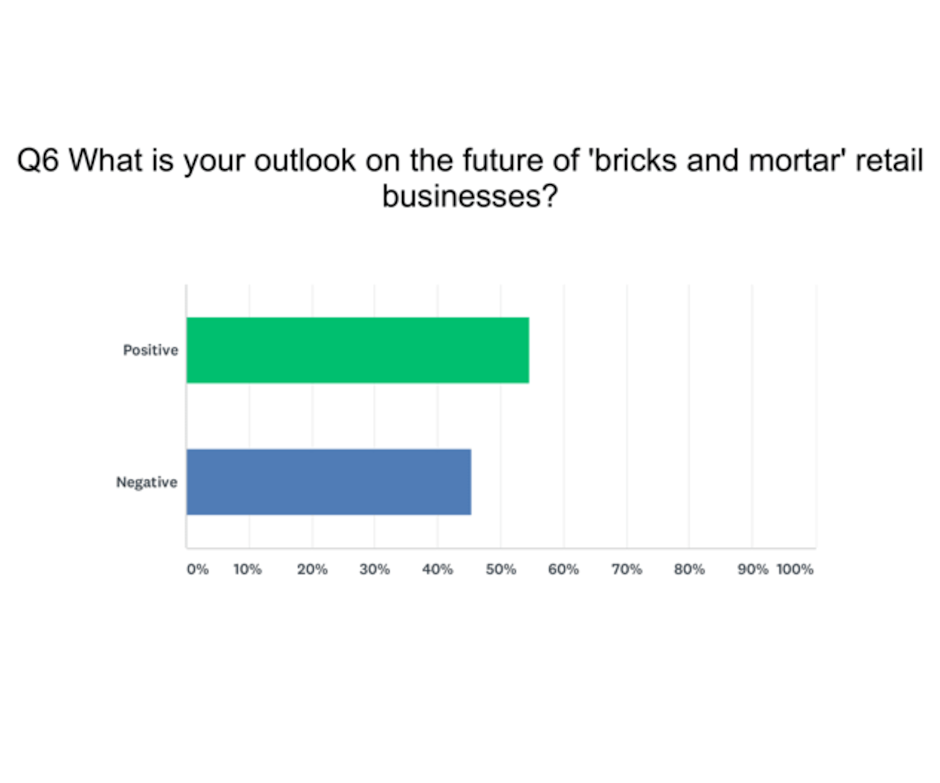

A question to separate the optimists from the pessimists, respondents were asked to give their outlook on retail businesses with physical premises, also known as ‘bricks and mortar’ businesses.

The answers were fairly evenly split with 55% of respondents stating they expected the outlook to be positive and 45% forecasting a negative future.

The reasons given for these respective outlooks were varied and reflected the answers given in other parts of the survey such as a positive outlook for customers to sample goods versus online as well as respondents with a negative outlook mentioning high rental costs and threats from online retailers and larger retail chains such as supermarkets.

Try Before You Buy

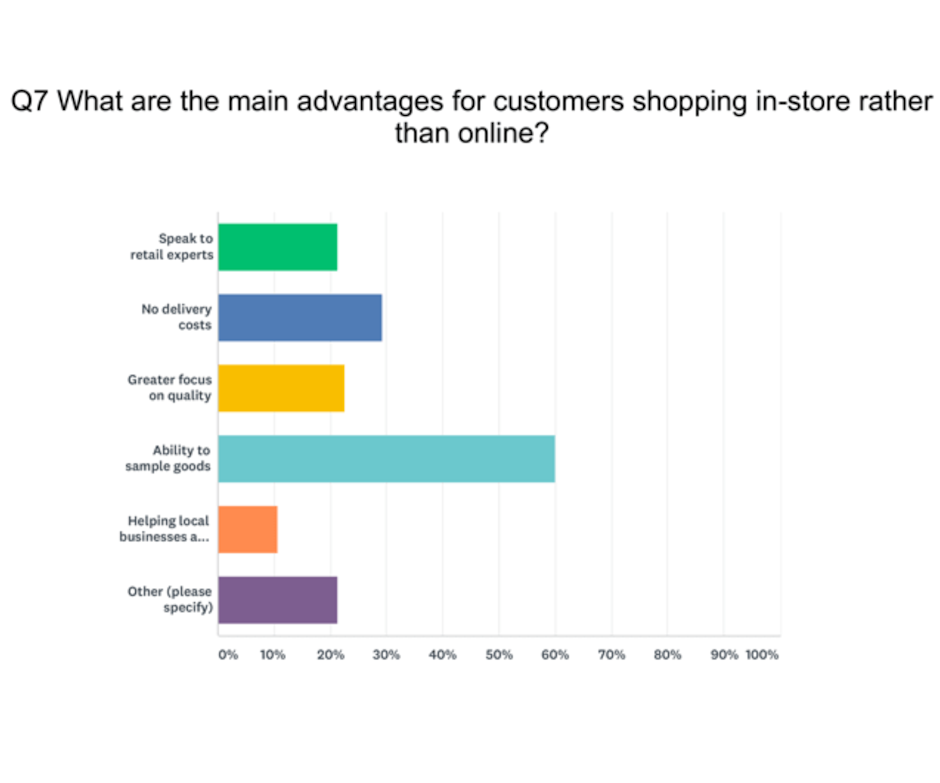

With the growth of online shopping having an adverse effect on retailers with a physical premises, ‘bricks and mortar’ retailers need to be able to shout about the advantages of shopping in-store versus online, which is why we asked this question about advantages for customers shopping in-store.

The number one answer for this was the ability to sample goods, with 60% of respondents selecting this as the main advantage for shopping in-store versus online.

Following this was the absence of delivery costs (29%); greater focus on quality (22%); and the option to speak to retail experts in-store (21%). 10% of respondents also gave the advantage of helping local businesses.

A large amount of respondents selected Other (21%), with answers given such as the social aspects of shopping in-store and the fact that in most cases shoppers don’t need to wait for deliveries given as reasons.

Overall, it’s clear that there are still several important benefits to shopping in-store such as the ability to sample goods, particularly important for clothing and shoe retailers, as well as the lack of delivery costs and waiting time as well as the social aspects of going shopping rather than buying online.

Brexit? It’s a Mystery

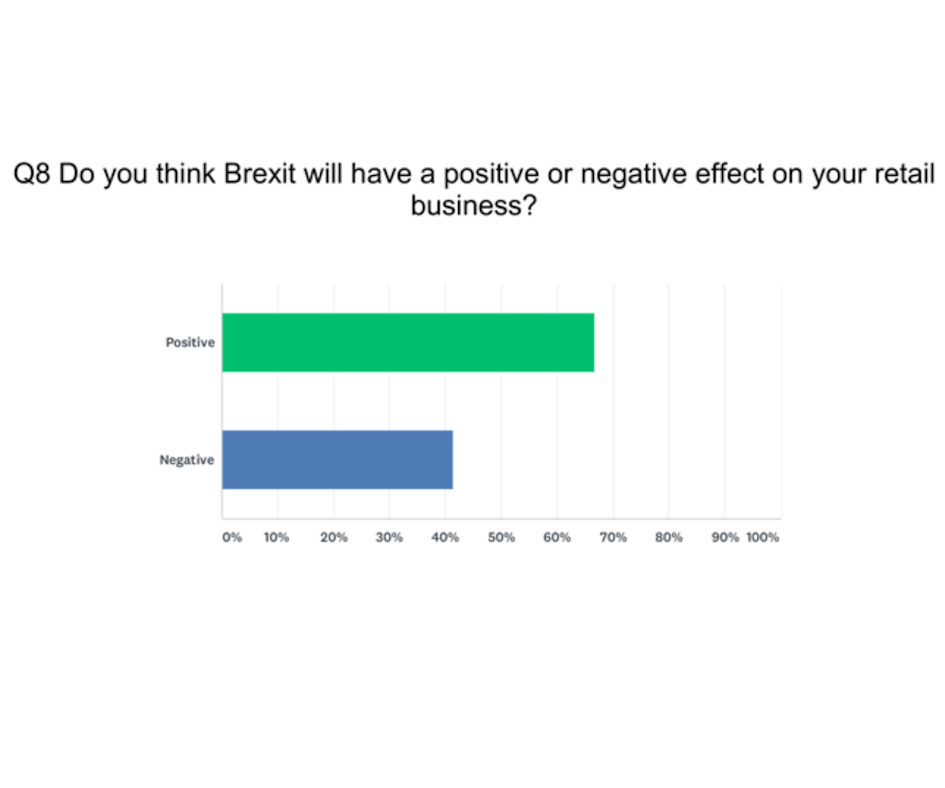

The hot topic in British politics has been debated throughout the country, with strong opinions for a positive and negative outlook on either side of the debate. This question asked the retail business owner or representative what they though the effect Brexit will have on their retail business.

It was closely run, with 66% of respondents thinking Brexit will have a positive effect on their business and 41% of respondents suggesting it will be negative (some respondents chose both options as they were unsure of the outcome).

Participants were allowed to choose more than one option which is why the result is more than 100%. Several participants chose both as they weren’t sure due to the political uncertainty.

Overall, most businesses were positive over the future effects of Brexit on their business, but many of the owners we spoke to were unsure whilst uncertainty prevails such as the trading arrangement with the EU not being finalised.

Government Assistance Crucial

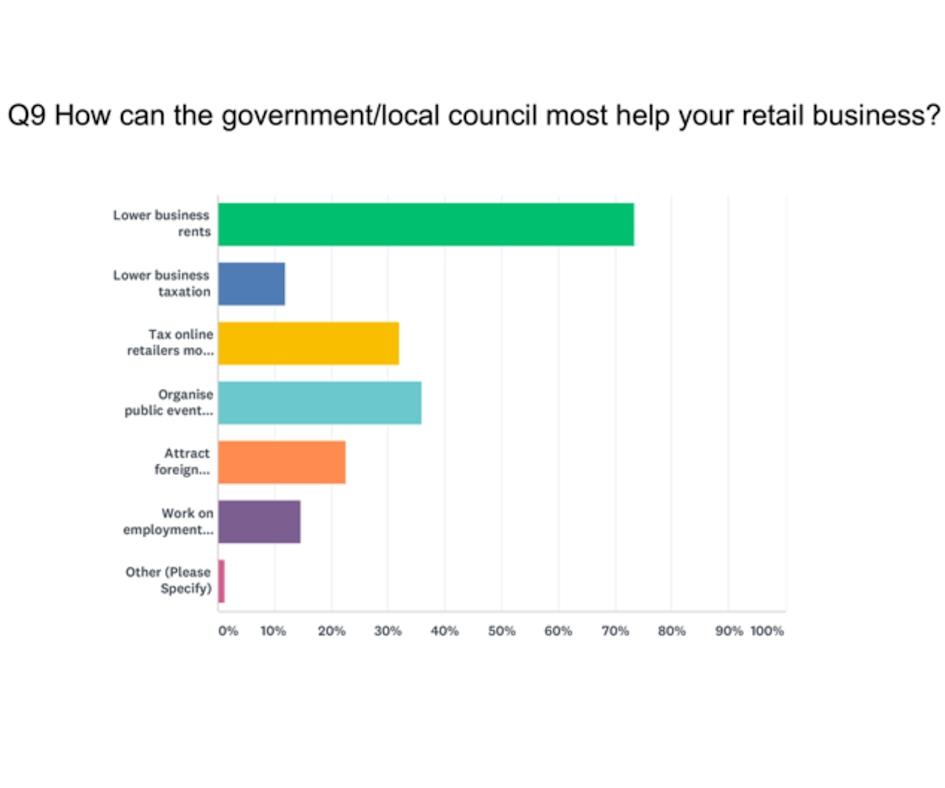

This question asked small business owners and representatives to outline how government or the local council can most assist their business.

The most popular option was overwhelmingly to lower business rates (73%), which ties in with the earlier question on business rental costs being the biggest issue facing ‘bricks and mortar’ retail businesses.

Other popular responses for ways government can help retail businesses were to organise public events held in shopping areas (36%); tax online retailers more (32%); and attract foreign investment (14%).

Retail store owners also though that government or local council could work on employment skills (14%) and lower business taxation (12%) to help their retail business.

Overall, there are several ways government and local council could assist small retail businesses with the most prominent being lowering business rates.

Retail Staff Not a Problem

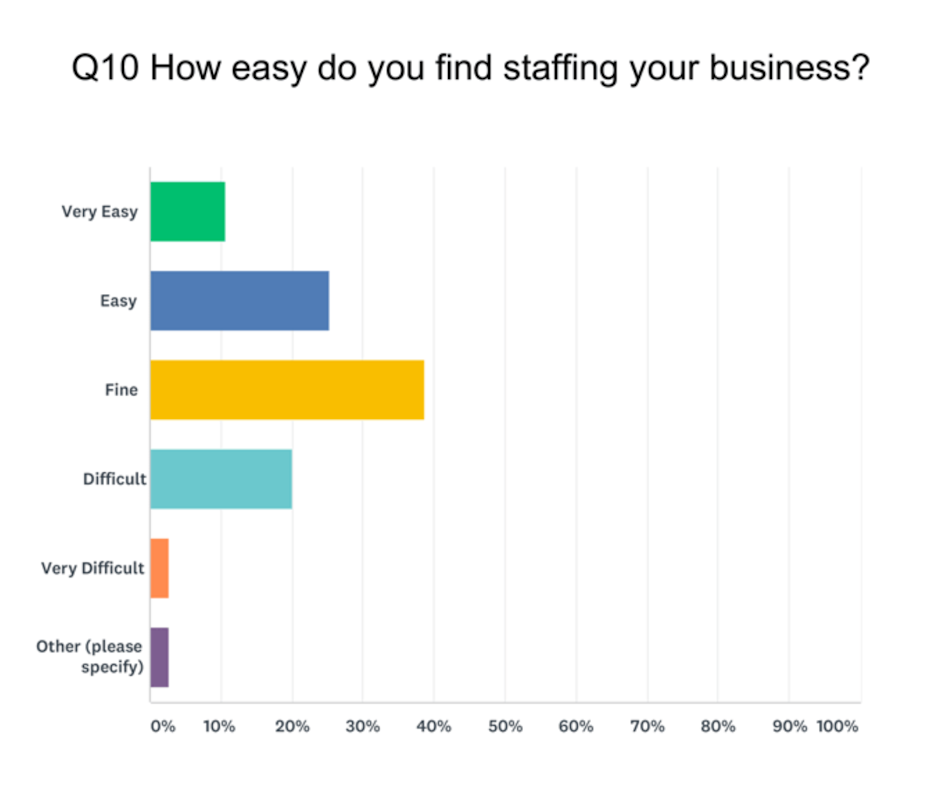

This question asked businesses to state how easy it is to find staff for their businesses.

The answers for this were fairly inconclusive but erred towards being easier rather than more difficult. The highest proportion of respondents chose the neutral ‘Fine’ as an option (38%), with 25% finding staffing ‘Easy’. 10% of respondents found staffing ‘Very Easy’.

On the other hand 20% of respondents said they found identifying and hiring staff as ‘Difficult’ with 2% saying it was ‘Very Difficult’.

Overall, it’s clear most small retail businesses do not have an issue finding new staff, showing a healthy talent pool for retail employees.

Methodology

This survey was carried out between November 2018 and January 2019 included responses from 75 small business owners or representatives from a range of retail businesses in high street locations.

The survey was conducted using SurveyMonkey in person across a number of small businesses on the high street, all of which had between 1 – 25 employees. The survey was also and distributed via email to the Display Wizard customer database as well as promoted on social media.

For any questions about the survey or to feature the data on your site, please email marketing@displaywizard.co.uk or call 01995 6006633.

posted in Marketing Advice

Share this Event